|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Understanding Chapter 7 Bankruptcy in Virginia: A Comprehensive Guide

What is Chapter 7 Bankruptcy?

Chapter 7 bankruptcy, often referred to as 'liquidation bankruptcy,' is a legal process that allows individuals to discharge most of their debts and get a fresh financial start. In Virginia, as in other states, this process involves the appointment of a trustee who oversees the sale of the debtor's non-exempt assets. The proceeds from the sale are used to pay creditors.

Eligibility Criteria for Chapter 7 Bankruptcy

Means Test

To qualify for Chapter 7 bankruptcy in Virginia, individuals must pass a means test, which compares their income to the median income of a similar household size in the state. If your income is below the median, you are likely eligible. If not, you may need to consider other bankruptcy options.

Credit Counseling Requirement

Before filing, you must complete a credit counseling course from an approved agency. This ensures that you are aware of your financial situation and alternatives to bankruptcy.

The Filing Process

Document Preparation

You will need to gather and prepare various documents, including tax returns, pay stubs, and a list of assets and liabilities. Detailed documentation is crucial for a smooth filing process.

Filing the Petition

The process begins with filing a petition with the bankruptcy court. This includes submitting forms that detail your financial situation, debts, and property.

Meeting of Creditors

About a month after filing, you will attend a meeting of creditors where the trustee and creditors can ask questions about your financial affairs.

Exemptions and Non-Exempt Assets

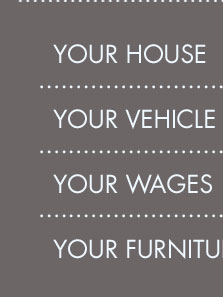

Virginia law allows you to keep certain property that is deemed exempt. This can include:

- Homestead exemption

- Motor vehicle exemption

- Personal property exemptions

Non-exempt assets, such as valuable collections or multiple vehicles, may be sold by the trustee to repay creditors.

Discharge of Debts

Once the trustee has administered the estate, eligible debts are discharged, meaning you are no longer legally required to pay them. However, certain debts like student loans and child support are typically not dischargeable.

Alternatives and Considerations

Before proceeding, consider consulting with a bankruptcy lawyer near me to explore alternatives such as debt consolidation or Chapter 13 bankruptcy, which may be more suitable depending on your circumstances.

FAQ

What debts are discharged in Chapter 7 bankruptcy?

Chapter 7 bankruptcy typically discharges unsecured debts such as credit card debt, medical bills, and personal loans. However, it does not discharge secured debts or obligations like student loans and child support.

How long does Chapter 7 bankruptcy stay on my credit report?

Chapter 7 bankruptcy can remain on your credit report for up to 10 years from the filing date. However, its impact on your credit score diminishes over time as you rebuild your credit.

Can I keep my car if I file for Chapter 7 bankruptcy in Virginia?

Yes, you may keep your car if it is within the exemption limits and you continue to make any necessary payments. Virginia allows a motor vehicle exemption up to a certain value.

Is it possible to file for Chapter 7 bankruptcy without an attorney?

While it is legally possible to file for Chapter 7 bankruptcy without an attorney, it is generally not recommended due to the complexity of the process. An experienced attorney can help ensure that you meet all legal requirements and maximize your exemptions.

Boleman Law offers everyone a free consultation with a skilled, experienced bankruptcy attorney to review and recommend options.

Chapter 7 bankruptcy is a liquidation where the trustee collects all of your assets and sells any assets which are not exempt.

Individual debtors are required to obtain credit counseling from an approved provider within 180 days before filing a case, and to file a certificate of credit ...

![]()